My Network Fund

Recently, I have made a transition from an entrepreneur in a failed startup to an employee in a multi-national corporation. I see this as part of the learning process that I need to go through before heading back to start another company in the future. I have learned that the hardest part about bouncing back from failure is to be patient, i.e. taking a step back from everything, learning the skills required for the next venture and wait for the right opportunity, time and place to get back to the arena.

“An idealist is a person who helps other people to be prosperous.” — Henry Ford

One crucial piece is to double down on my network fund which I have built over the years. Through online social networking services such as LinkedIn, Twitter and Facebook, I have built, maintained and engaged my contacts over different channels. No matter how the digital tools help to organize the address book of people who I have met, nothing beats a face to face meeting.

Currently, I am living in Singapore and we have a startup community that spans across the whole of Southeast Asia. Lately, many entrepreneurs and investors from the US and Europe have travelled to Asia in search of new opportunities. Hence, I have made it a point to take at least two meetings a week either early in the morning or late in the evening with people from all walks of life. I usually only take meetings from a stranger if he or she has been referred by someone who I know in real life. Unless he or she has a compelling value proposition, it is unlikely of me to take cold calls. Once every few months, I will take half a day of leave to spend time as an EiR in INSEAD Business School to meet up with MBA students who are planning to start their new ventures here in Asia. Sometimes, I meet them near my workplace before or after office hours and hear their story. So, in short, I am blessed with many meeting opportunities to hear many people sharing their own interesting stories with me.

The “Investment” Principles in my Network Fund

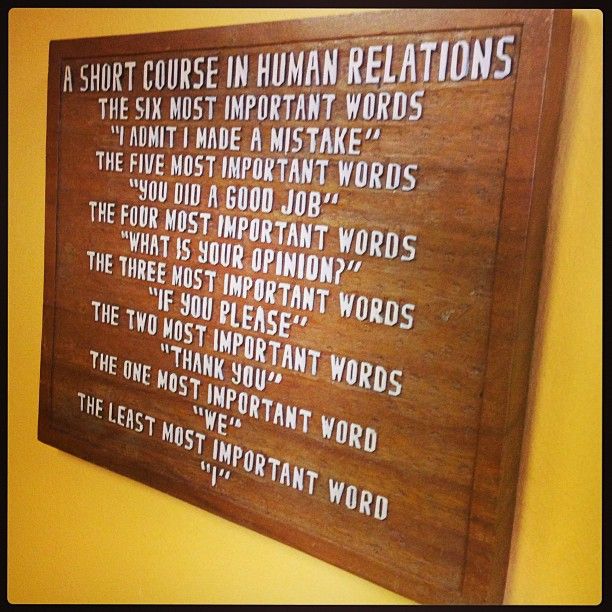

Over the years through networking and meeting new people, I set the mission of my network fund to do one thing: to enable and connect people and be of value without expectation of any return. If I get anything in return, it is a bonus rather than an entitlement.

I have adopted the following guiding principles for my network fund:

1. Listen and understand what the person is looking for: Depending on the flow of conversation, if possible, hear his or her story and figure out what he or she needs. I will usually take the story in good faith and if it turns out that I discover that the person has lied, I will cease the follow-up communication very quickly.

2. Share what you know and be upfront about things: As the central tenets to the network fund are credibility and trust, I will share what I know and be upfront about the good and bad on anything. For example, when overseas investors and entrepreneurs from Europe and US are here to raise funding or build a new venture, I often list the problems and challenges faced by the local community so that they are not under any illusion. My view in life is that we should be honest to people about things even if it is not what they like to hear. When it comes to hearing pitches and ideas, I just give my impressions and that includes the disagreements I have with the idea. I end with one disclaimer to the person who pitched the idea that I disagree with, “Please do not accept my opinions as final. If you believe that this is what you want to do, please go ahead and start. I am happy to be wrong in that situation.”

3. Determine how I can be of help and do the follow ups: Upon the conversation ends, I will determine how I can be of help and set the follow ups for the person who I meet. For introductions, I tend to do it within three days unless I am out on a holiday or be bogged down by domestic matters (for example, taking care of a new born). Sometimes, my record is about 99% given that I may occasionally miss. There are times that I will not provide any assistance and typically it is that it is not relevant to the person who they wanted me to introduce.

Sometimes, the follow up is just to seek an introduction to the editorial team of a media outlet I own. Typically, I will do the introduction not just to my team, but also to the other media outlets who are perceived as “competitors” to us. In my worldview, the Southeast Asia entrepreneurial ecosystem is very small and it is not really beneficial for us to fight each other but work together to expand the pie. Even if they do not think so, I prefer to operate this way so that I can provide better value in my personal capacity. For my meetings as an entrepreneur-in-residence in INSEAD, I will ask the student if I have provided any value for them. If I don’t, I should not be there.

In short, I enjoyed building my network fund and sometimes, my happiness come in the joy of helping others to succeed or attain their goals to what they enjoy doing. That, to me, is the greatest return of all.