Why Digital Transformations Fail I - The Incumbent & Disruptor Dilemma

In the first of the “why digital transformations fail” series, I want to highlight the rarely discussed incumbent and disruptor conundrum that are faced by many senior leadership executives and board members. In the same conversation, a few potential solutions are proposed to address this complex problem.

In the past decade, as many traditional companies facing disruption from young and dynamic upstart companies, they are forced to undergo transformations or to be specific, digital transformations. How did that happen? Most companies in traditional industries have been business as usual and put very little investment into their technological or digital infrastructure. When new digital companies started to infringe into traditional industries such as logistics, banking, insurance and real estate, chief executives and board members started to wake up and realized that they need to do something.

As a practitioner, I have made a couple of observations about how I know when transformations fail. No digital transformation and even the ones which I have executed are without problems. Surprisingly, most of these problems are related to people and organizational structures. As I often put it in a succinct manner, “People love to talk about transformation but they hate to change.”

There are some problems relating to the execution of digital transformations which are well documented in Harvard Business Review along with other business periodicals and journals. But there are some deep issues that are prominent but are always swept under the carpet. When I sit in different private roundtables, these hidden problems are discussed by chief digital officers, chief information officers & chief innovation officers but if I probe deeper, they rarely surfaced to boards or business owners out there.

One specific problem that is rarely discussed is what I termed as the incumbent & disruptor dilemma in digital transformations. The best way to characterize is the following:

There is an incumbent with a declining business that is generating significant revenues (typically more than 30%) or profits (about 10% EBITA) and has either refused to invest in digital technologies or suffer significant technical and management debt at the same time. The CEO brings in a disruptor in the form of the chief digital or transformation officer in the view to fix the declining business by turning it omnichannel with the use of digital technologies. The incumbent, out of fear of the disruptor eating his lunch, will set to find ways to stop the disruptor from succeeding by blocking resources or stonewalling the changes that need to be made for the business. As a result, the overall business suffers a loss of revenue with the disruptor leaving the company and the incumbent staying with the revenues declining further till the point of no return. The CEO and board have no choice but to explain the failure of the digital transformation and let the company die or get acquired.

The best way to think about this as I often do is to think from different perspectives. I often adopt this approach because I have been sitting in the disruptor role. Once you analyzed the different perspectives, you will realize why the incumbent and disruptor will act in different ways that accelerate the failure of the business unit and the mis-alignment of incentives is so glaring in hindsight.

Let’s start with the disruptor first, because it’s the easiest and most instinctive from my point of view. The disruptor is mandated to bring digital technologies to shift the business into an omnichannel world where customers can access the same products and services. As with everyone, building digital revenues takes time as we have witnessed money-burning startups that can push the traditional business to their needs. Most companies are afraid to fight fire with fire because if they are public, the stakeholders will push them not to do that.

While it’s easy to buy or build technologies and platforms to augment the traditional channels, the number one challenge that remains for the disruptor is distribution. Distribution is important to how businesses succeed. What I mean by distribution here, is the sales and marketing channels that have enabled the traditional business to succeed in the past. The problem is that the disruptor does not own the distribution. Sometimes in order to achieve synergy to build more revenues for the businesses, the disruptor needs to integrate his digital channels into the current operations or workflow of the traditional business. Hence in order for the disruptor to succeed, he needs the distribution and the operations workflow that integrate the digital channels as part of the ingredients to succeed. The other problem which the disruptor faces are what I call the “your revenue is insignificant” problem. If there is no investment, there is no growth, and if you don’t start to shift your business focus, external forces such as well-funded cash-burning startups by venture capitalists will threaten the business and send it to downright spiral. Most boards and CEOs love the 80:20 rule but in disruption, the 80:20 rule is inadequate for the overview of where the business is heading. They forgot how the company succeeded when it was still a startup or upstart, and where they are now is different from the past.

How about the incumbent? The incumbent business owner is typically an older person who runs the business for a significant amount of time and has optimized the operations and workflow of the business to ensure that it keeps generating profits for the businesses. The incumbent is extremely fearful of the disruptor for a few reasons which anyone can totally understand from his or her perspective.

First, the incumbent has to pay for the disruptor to exist. In most businesses, the CEO will coerce the incumbent to fund the disruptor’s businesses. If the disruptor succeeds, it means that the incumbent can be replaced. So, if you are the incumbent, what will you do? Of course, the natural instinct is a zero-sum mentality. The disruptor has to lose in order for the incumbent to survive. Out of every ten situations, I am going to guess, nine out of ten CEOs will back the incumbent if the disruptor starts to complain about the incumbent is not helpful. Two, the incumbent is not given the incentives to ensure the disruptor succeeds. He or she is likely to be subjected to a 5-30% year-on-year growth for the business unit. There is no chance for him or her to succeed unless he or she cuts costs. Where do you think he or she will cut? Of course, it’s the disruptor. By adopting a passive-aggressive stance on the disruptor, the incumbent can make the argument if the disruptor increases his or her costs, the incumbent is unlikely to hit his key performance indicators. Third, the incumbent is a risk of losing his job if the disruptor succeeds. Most companies have no succession planning or provide incentives for the incumbent to go to their next roles or stage of careers. That’s probably why their only survival instinct is to make sure that the other guy does not succeed.

Very few incumbents in different businesses will want their disruptors to succeed. I have seen one or two incumbent business unit owners, but these people are the ones I truly respect because they see the success of the organization as more important than themselves. I often go in that spirit but I have yet to see many incumbents really want to do the right thing. To survive, I have decided that my role as the disruptor is just a tour of duty, given where I want to head (which is really not to work in the same organization for a very long time). My perspective is that I will hand the reins back to the incumbent when I am done with the digital transformation (despite the hostility).

That begs the question. Are there any potential solutions that can resolve this incumbent and disruptor dilemma? Here are a few solutions which I propose (based on my private discussions with various executives).

- Give the disruptor the full P&L and the incumbent business unit: To me, this is a no-compromise situation and very few such situations happened in reality. It’s vertical integration in a way and of course, I favour this approach given that I had that situation once. This usually happens when the incumbent is totally working in a zero-sum mentality and will adopt passive-aggressive stances to slow things down. Here’s my argument for why this works better than the other way around. Think of a business major, there’s very little chance that this person can run a technological and digital product team, but if you put in a science or engineering major who has the right set of skills and expertise, and with logic, you can learn easily what the business major can learn. The information asymmetry or specialization provides the disruptor with the advantage to run a traditional business unit by adding the right digital products and integrating them to change the supply chain that can build new revenues for a dying business. There is the extra motivation for the disruptor who will not attempt a complete overhaul but given the set of constraints put incremental innovation that improves the business both in the short and long term.

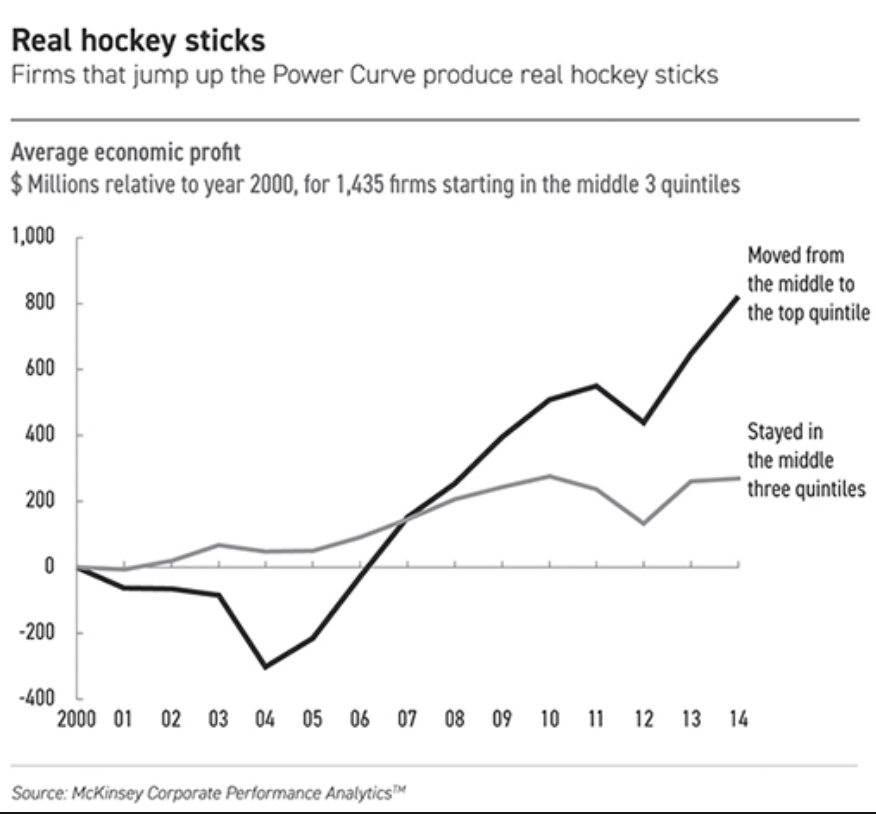

- The CEO and board have to create a set of stretched but realistic goals, targets and milestones that aligns the interests of the incumbent and disruptor: This is a middle-of-the-road solution. Most executive leadership teams and boards adopted this approach but avoided the execution. The reason is that there are a set of difficult conversations to which everyone from the CEO, disruptor and incumbent have to agree to. A senior executive who I respected, suggests the concept of a shadow P&L that aligns the goals for both the incumbent and disruptor. Let me take this idea a bit further and how this approach can work but require three ingredients coming together: (a) the CEO and board have to manage their expectations and adjust the growth targets for the incumbent and provide a budget for the disruptor to get things working, (b) the incumbent needs to provide a set of cost-saving measures while retaining the profits without killing the golden goose of the company and (c) the disruptor has to first put the digital infrastructure in place to integrate into the existing distribution advantage of the incumbent and then generate the revenues. In fact, most of the time, these conversations never took place. How does the CEO convince the board about the hockey stick growth for why digital transformation will rejuvenate the business? This graph below from Bradley, Hirt and Smit’s “Strategy Beyond the Hockey Stick” offers a realistic picture of how transformations create long-term value with those companies which made it work.

- Put the disruptor reporting to the incumbent: This approach is very popular and fails 99% of the time (which I am pretty sure if the data exists). The reason is extremely simple. The incumbent will move forward with business as usual and has zero incentive to allow the disruptor to flourish. Digital integration is a form of window dressing and the incumbent has no incentive to change the current set of operations and processes because it is highly optimized till now.

- Hide the disruptor somewhere and let it run like an independent company against the incumbent: It’s an interesting approach but very few companies have managed to do that because the first instinct from the board and executive leadership is to reintegrate the company into the current one. The approach is simple: hide the company from the incumbent and let it run like an independent startup till the point it can challenge the incumbent. This obviously set up alarm bells for the incumbent and they will refuse to work with the independent disruptor sitting elsewhere. So, is there an example out there? Well, in the early days of Alibaba Group, Jack Ma took a team of engineers and create Taobao, which is an eBay-like marketplace. They did not let the rest of their team know that it’s part of Alibaba till everyone in the company highlighted it as a threat against their other competitor, eBay China. Tencent’s Wechat is the other prominent example that shift the paradigm of the company from desktop to mobile messaging and killed their golden goose, QQ desktop messenger. It’s surprising that you have not seen similar examples from US companies. Why do you think that the General Motors and Ford out there have not created a Tesla competitor?

The incumbent & disruptor dilemma is a difficult subject which I suspect many companies have but are afraid to talk about it in a meaningful and thoughtful manner. I have yet to see upfront conversations on this topic across boards and executive leadership teams. However, most traditional companies are in the midst of their digital transformations and the threat of external competition might not be imperative to them.

To end, I like to leave this quote from Daenerys Targaryen, a fictional character from the “Game of Thrones” television series for those who are in board positions and executive leadership to think about the dilemma when it comes to disruption.

“They can live in my new world or they can die in their old one.”– Daenerys Targaryen from Game of Thrones.

Acknowledgements: I thank Charles Anderson, my mentor - Paul Cobban and my wife - Yuying Deng, together with many unnamed senior chief digital executives with who I have discussed this topic on different occasions.